28+ Variable mortgage calculator

Use this calculator to figure your expected initial monthly payments the expected payments after the loans reset period. A mortgage calculator can show you the impact of different rates on your.

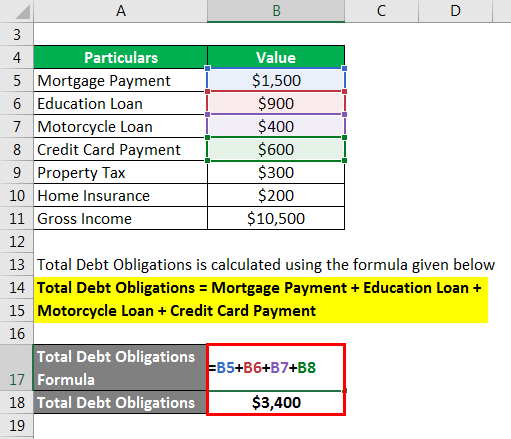

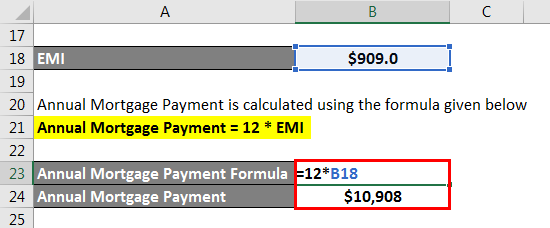

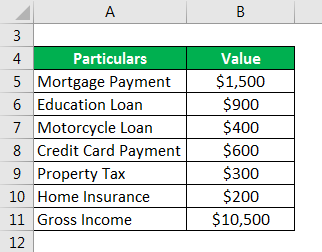

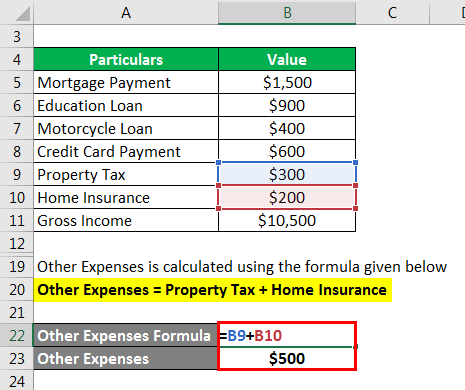

Total Debt Service Ratio Explanation And Examples With Excel Template

In many countries 25-year mortgages are structured as adjustable or variable rate loans which reset annually after a 2 3 5 or 10 year introductory period with a teaser rate.

. How much you can afford in monthly payments and whether you have the risk tolerance for a variable-rate loan versus a fixed-rate loan. We will always tell you in advance if it is going to go up or down and how your monthly repayment amount will change as a result. However the Compare.

Use Mortgage Repayment Calculator to calculate monthly extra payments amount of interest paid also with offset account on your home loan or mortgage. After the intro APR offer ends 1624 - 2624 Variable APR will apply. However if your lenders standard variable rate rises so will the percent you have to.

If your mortgage is insured then the qualifying rate is the higher of. In contrast the average variable rate mortgage was priced at. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

- Your mortgage was funded under a specialty program for example Progress Draw Construction mortgage. Thinking of getting a 30-year variable rate loan with a 3-year introductory fixed rate. Scotiabank Mortgage Calculator allows you to calculate your mothly mortgage payments and cash required for real estate purchases using current Scotiabank rates.

Or one could have a 228 or 327 ARM. For mortgages with a variable rate youll generally be charged a pre-payment penalty equal to 3 months interest of your outstanding mortgage at your current rate. APRC Annual Percentage Rate of Charge calculations are based on the cost per month on a 100000 mortgage over 20 years.

When purchasing a home many buyers typically start off with an introductory mortgage rate. The average interest rate for the most popular 30-year fixed mortgage is 548 according to data from SP Global. SVRs usually come with a higher interest rate than other loan options.

Use our mortgage calculator to calculate how much you can borrow or try our mortgage repayment calculator to estimate your monthly repayments. How a LendingTree Mortgage Works. If youre a Preferred Rewards member you can earn 25-75 more points.

A 3 fee min 10 applies to all balance transfers. Where the prepayment charge is an interest rate differential the calculator tool estimated tool results will be in most cases be a higher amount than the actual prepayment charge. Mortgage interest rates are always changing and there are a lot of factors that.

This mortgage calculator uses the most popular mortgage terms in Canada. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Most homebuyers in America tend to obtain 30-year fixed-rate mortgagesAs of June 2020 the Urban Institute reports that 30-year fixed-rate loans account for 77 percent of new mortgages in the market.

The Bank of Canada five-year benchmark rate of. - Your current term began prior to January 2010. Its popularity is due to low monthly payments and upfront costs.

The monthly payment formula is based on the annuity formulaThe monthly payment c depends upon. Years Principal Interest Balance. 30-Year Mortgages and Extra Payments.

The most common home loan term in the US is the 30-year fixed rate mortgage. This can last for 2 to 5 years depending on the type of mortgage you choose. Depending on the contract other events such as terminal illness or critical illness can.

Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. The fixed monthly payment for a fixed rate mortgage is the amount paid by the borrower every month that ensures that the loan is paid off in full with interest at the end of its term. Mortgage loan basics Basic concepts and legal regulation.

A variable rate mortgage the interest rate is dictated by the prime rate with any changes reflecting on the principal not the fixed. So if your lender had a 5 percent standard variable rate and this mortgage gave you a 2 percent discount you would pay 3 percent. The average fixed-rate mortgage was priced at 191.

Variable fixed principal and interest PI home loans with an LVR loan-to-value ratio of at least 80. Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policy holder. Calculator Rates 3YR Adjustable Rate Mortgage Calculator.

The one-year two-year three-year four-year five-year and seven-year mortgage terms. R - the monthly interest rateSince the quoted yearly percentage rate is not a compounded rate the. The above calculator is for fixed-rate mortgages.

A Discount Rate Mortgage is a mortgage where you pay a lower than the normal standard variable rate for a set number of years. With several primary inputs as well as additional advanced fields that account for PMI homeowners insurance zip codeproperty taxes and homeowner association fees Guaranteed Rates home mortgage calculator incorporates almost every conceivable variable that could affect your mortgage costsThe result is an estimate of future monthly. A variable rate mortgage has a rate of interest which can change.

A variable mortgage rate can result in a lower lifetime. 525 oryour current interest rate plus 2. Once the introductory period ends your mortgage reverts to the standard variable rate SVR mortgage.

A variable rate mortgage is defined as a type of home loan in which the. For example if the interest due in your next monthly payment is 1500 your pre-payment penalty would be 4500. This lets us find the most appropriate writer for any type of assignment.

Loan to Value variable rate applicable at that time. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses.

28 Location Location Location. Rate is variable or fixed. With this format the first number.

The Bank of Canada five-year benchmark rate of. 93028 Oct 2022 92790 Nov 2022 92552 Dec 2022 92313 Jan 2023 92073 Feb 2023. If your mortgage is uninsured then the stress test will be calculated at a qualifying rate which is the higher of.

Our Canadian Mortgage Calculator allows you to calculate your monthly mortgage payments and cash needed for the purchase of real estate using current lender rates.

Total Debt Service Ratio Explanation And Examples With Excel Template

Download A Free Home Mortgage Calculator For Excel Analyze A Fixed Or Variable Rate Mortgage And Inclu Mortgage Loans Financial Calculators Refinance Mortgage

In A Fixed Rate Mortgage The Interest Rate Is Pre Determined At The Beginning Of The Loan Term 6 Fixed Rate Mortgage Mortgage Interest Rates Mortgage Rates

Rule Of 78 Calculator Double Entry Bookkeeping Amortization Schedule Calculator Interest Calculator

Loan Servicing How Does Loan Servicing Work With Example

Total Debt Service Ratio Explanation And Examples With Excel Template

Subprime Mortgage How Does Subprime Mortgage Work

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Rental Property Management Income Property

Total Debt Service Ratio Explanation And Examples With Excel Template

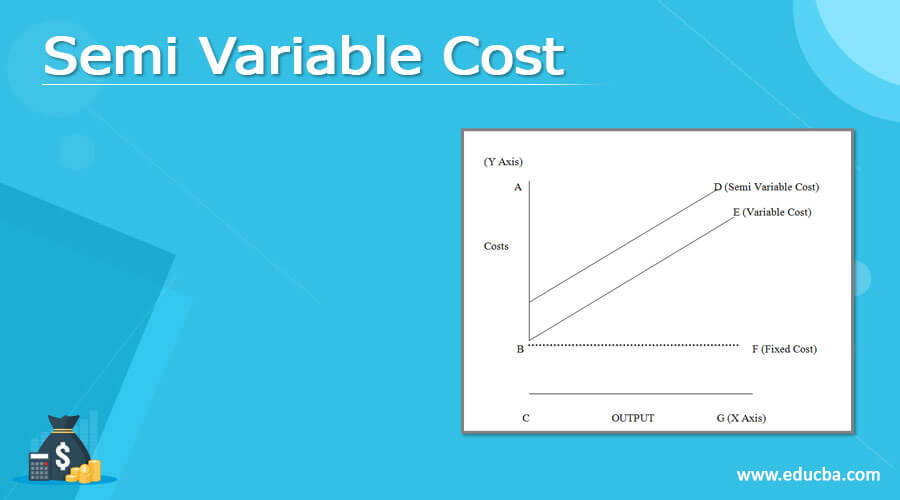

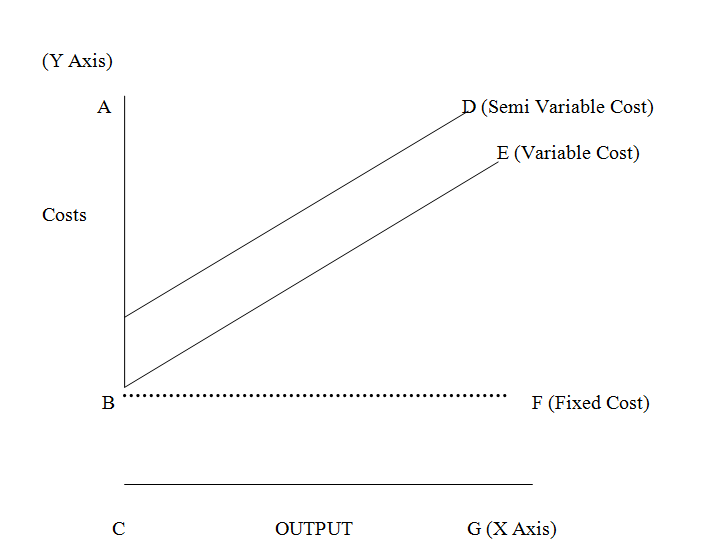

Semi Variable Cost Examples And Graph Of Semi Variable Cost

Total Debt Service Ratio Explanation And Examples With Excel Template

Total Debt Service Ratio Explanation And Examples With Excel Template

Mortgage Calculator By Digital Designer Calculator Design Mortgage Calculator Mortgage

Total Debt Service Ratio Explanation And Examples With Excel Template

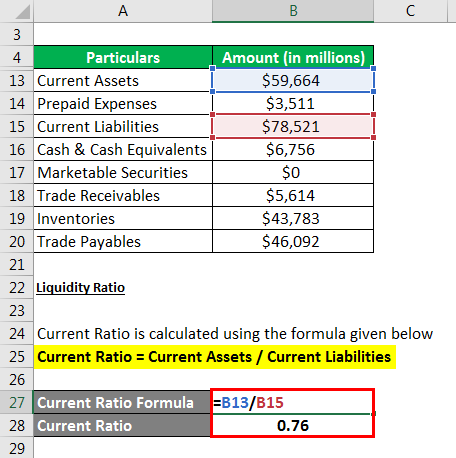

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Phhesj5oaq5kim

Semi Variable Cost Examples And Graph Of Semi Variable Cost